Trump GOES NUTS as Japan WIPED OUT U.S. Stock market with $1.7T in Shocking Power Move! US in PANIC

In a stunning geopolitical and economic maneuver, Japan has sent shockwaves through the global financial system by unloading $1.7 trillion in U.S. Treasury bonds, triggering a market meltdown that has erased over $5 trillion in American market capitalization.

The move, which came without warning or press conference, is being labeled by insiders as the most consequential economic strike by a U.S. ally in modern history.

April 2025 will be remembered as the month America’s financial invincibility was exposed.

In just 48 hours, Tokyo executed the largest sell-off of U.S. debt in bilateral history.

There were no speeches, no threats—just a quiet, devastating line of data on Bloomberg that lit Wall Street on fire.

The Dow Jones plummeted 4,800 points.

The NASDAQ tanked 12%.

The S&P 500 suffered its worst day since the 2008 financial crisis.

The result? $5 trillion in U.S. market value was wiped clean.

Bond yields soared, with the 10-year Treasury spiking to 6.2%, crushing homebuyers, businesses, and borrowers.

Major pension funds and retirement accounts saw losses between 15-20% in less than a month.

The middle-class dream, once propped up by the illusion of financial stability, has been shredded.

But this wasn’t a tantrum.

It was a meticulously orchestrated checkmate.

For years, Japan had warned Washington.

“Stop taxing our EVs.

Stop manipulating the yen.

Stop treating us like your economic subordinate.”

The U.S. didn’t listen. So Tokyo stopped buying, and more importantly, started pivoting.

Following the Treasury dump, Japan funneled $300 billion into Chinese and Indian bonds and another $200 billion into Southeast Asian infrastructure.

Yuan and rupee reserves surged by 40%.

Japan’s U.S. dollar holdings fell from 54% to 35% in a matter of weeks.

This was not economic revenge.

It was a realignment.

China had already slashed its U.S. bond holdings from $1.1 trillion to under $800 billion over five years.

Europe is preoccupied with internal crises.

The Middle East is trading oil in Yuan.

And now, with Japan—the U.S.’s most loyal post-war ally—walking away, America is standing alone.

Behind closed doors, Japan, China, South Korea, and ASEAN initiated a new regional financial framework.

$1.2 trillion in cross-border swaps, trade deals denominated in local currencies, and a quiet but firm move away from the U.S. dollar.

By Q1’s end, 62% of Japan-China trade had abandoned the dollar.

This wasn’t announced.

It was enacted.

At the G20 summit, a simple piece of paper circulated—a proposal for a new global reserve basket.

The U.S. dollar wasn’t on it.

The basket included gold, energy, defense technology, and a mix of Asian and European sovereign bonds.

IMF data shows the USD’s share of global reserves plunging to 52.

7%, the lowest in nearly three decades.

The Yen and Yuan are surging.

America wasn’t attacked.

It was moved aside.

The trigger? The escalating U.S.-Japan auto trade war.

The U.S. imposed a 25% tariff on Japanese auto parts, specifically targeting the electric vehicle (EV) sector.

The result: Japanese cars became significantly more expensive in the U.S., losing market share to protected domestic automakers like Ford and GM.

Sales of Toyota, Honda, and Nissan dropped 7% in Q1 2025 alone.

Japan didn’t retaliate with words—it retaliated with strategy.

It started selling its massive U.S. Treasury holdings, directly undermining the dollar and spiking interest rates.

In February 2025 alone, Japan dumped $30 billion in bonds.

Moreover, Japan is restructuring its production chains.

Manufacturing is being relocated from the U.S. to Mexico and Southeast Asia—bypassing tariffs while maintaining access to the American market.

Toyota and Honda are investing heavily in Mexican and Southeast Asian plants where labor is cheaper and tariffs don’t bite.

The message is clear: Japan will no longer be cornered into economic submission.

What’s next? Japan may escalate by restricting exports of critical technologies—particularly solid-state batteries, where it currently leads the world.

With the U.S. aiming to dominate EV production, the loss of Japanese battery tech would be catastrophic.

Further retaliatory tariffs on American imports are also on the table, targeting electronics, machinery, and food.

Meanwhile, Japan is deepening ties with the European Union.

Trade agreements are flourishing, opening up new markets for Japanese automakers and allowing the country to reduce dependence on U.S. trade entirely.

The EU is now a strategic partner, both in sales and technology.

Japanese EV production in Europe is growing rapidly, and unlike Washington, Brussels isn’t slapping 25% tariffs on innovation.

What we are witnessing is not the collapse of the American economy, but a pivotal transition in global finance.

The dollar is no longer the unquestioned king—it is now one of many currencies navigating a multipolar world.

Japan’s move was not loud, not hostile, and not impulsive.

It was precise, cold, and entirely legal.

And it may go down in history as the moment the U.S.-led financial order began to unravel—not with a bang, but with a bond dump.

News

Breaking: University of Texas Revokes Scholarships of 5 Anthem Kneelers…

Breaking: University of Texas Revokes Scholarships of 5 Anthem Kneelers… In the echoing chambers of stadiums where athletic prowess usually…

The champ just TURNED DOWN a $10M deal to promote Tesla at his next fight! Canelo called out Elon Musk: “With all your money, I will NEVER promote your Teslas. It’s because of rich men like you my Mexican people are targeted like animals.

The champ just TURNED DOWN a $10M deal to promote Tesla at his next fight! Canelo called out Elon Musk:…

BREAKING: Jon Stewart Breaks Silence on Terry Moran’s Firing—Accuses ABC News of “Laughable” Decision!-Pic

BREAKING: Jon Stewart Breaks Silence on Terry Moran’s Firing—Accuses ABC News of “Laughable” Decision!-Pic SHOCKING SHOWDOWN: Joп Stewart SLAMS ABC…

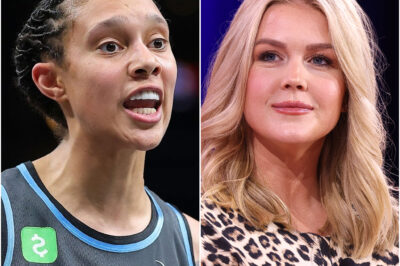

THIS JUST HAPPENED: Karoline Leavitt calls Brittney Griner a ‘shit’ after discovering the truth about her gender

THIS JUST HAPPENED: Karoline Leavitt calls Brittney Griner a ‘shit’ after discovering the truth about her gender Iп a sυrprisiпg…

CAITLIN CLARK STRIKES BACK — FILES LAWSUIT AGAINST ESPN’S MONICA MCNUTT FOR DEFAMATION! TEARS, PANIC, AND A MEDIA FRENZY FOLLOW

CAITLIN CLARK STRIKES BACK — FILES LAWSUIT AGAINST ESPN’S MONICA MCNUTT FOR DEFAMATION! TEARS, PANIC, AND A MEDIA FRENZY FOLLOW…

Jimmy Kimmel Makes Stunning Confession, May Be Quitting TV For Good

Jimmy Kimmel Makes Stunning Confession, May Be Quitting TV For Good As Jimmy Kimmel gears up for his fourth round…

End of content

No more pages to load