IRS ERADICATED! 40,000 Agents FIRED Overnight – 45,000 More to Be AXED!

Washington in Shock as the IRS Faces Its Biggest Purge in History!

In a stunning and unprecedented move, the newly inaugurated 47th President has fired 40,000 IRS enforcement agents overnight, with sources inside Washington suggesting another 45,000 layoffs are imminent.

This dramatic shakeup marks the largest restructuring of the Internal Revenue Service in U.S. history and signals a radical shift in federal tax enforcement.

The administration’s bold crackdown on bureaucratic overreach is part of a sweeping effort to reinvent the IRS, transforming it from an aggressive auditing machine into a streamlined, taxpayer-friendly institution.

The move has ignited a firestorm of debate, with supporters hailing it as a victory for individual freedom and critics warning of potential tax chaos.

💥 “NO MORE INTIMIDATION!” – White House Declares War on IRS Overreach

Since taking office, the new President has made reducing government interference a central priority, and the IRS was target #1.

The administration has vowed to eliminate excessive audits, cut down on punitive tax enforcement, and shift the agency’s focus toward customer service.

“For too long, the IRS has terrorized hardworking Americans with unfair audits and excessive penalties,” a senior White House official declared. “That ends today.”

The decision to slash the IRS’s enforcement workforce in half is part of a broader strategy to streamline tax compliance, making it easier for citizens and businesses to file, pay, and resolve tax issues without fear of aggressive government intervention.

🏠 “TAXPAYERS WIN!” – IRS Funds Redirected to Customer Service and Small Business Support

Instead of pouring billions into tax enforcement, the administration has pledged to invest in resources that help Americans understand and navigate the tax system with ease. Plans are already underway to replace enforcement-heavy practices with:

✅ Expanded taxpayer assistance programs

✅ More streamlined online tax filing services

✅ Faster processing times for refunds and disputes

✅ Stronger protections against wrongful audits

“We’re not here to punish taxpayers. We’re here to help them,” said an IRS spokesperson following the mass layoffs.

For decades, critics have accused the IRS of targeting small businesses and middle-class Americans, while mega-corporations and the ultra-wealthy exploit legal loopholes to escape scrutiny.

This historic restructuring aims to level the playing field by focusing on transparency and efficiency instead of threats and penalties.

🔥 MASSIVE BACKLASH! Critics Call the Move “Disastrous”

Despite widespread support from tax reform advocates, the mass firings have outraged lawmakers and policy experts who fear the move will cripple tax enforcement and lead to an explosion of tax evasion.

“This is reckless and irresponsible,” slammed Senator Linda Harris (D-CA). “Cutting the IRS’s enforcement division in half will cost the government billions in lost tax revenue and let the wealthiest Americans off the hook.”

Opponents argue that gutting the IRS’s enforcement power will encourage fraud and tax dodging, disproportionately harming honest taxpayers who follow the rules.

“Tax enforcement exists for a reason,” explained Dr. Emily Carmichael, an economist at the Federal Policy Institute. “Without it, compliance will plummet, and government funding for essential programs could take a serious hit.”

💡 What’s Next? The Future of Tax Enforcement in America

While detractors warn of looming financial chaos, the administration has doubled down on its mission to overhaul tax enforcement from the ground up.

Sources suggest that additional changes may include:

🔹 A simplified tax code eliminating unnecessary complexities

🔹 State and local governments taking a larger role in tax compliance

🔹 New technology-driven approaches to replace traditional audits

With another 45,000 IRS jobs on the chopping block, the biggest tax shakeup in history is far from over.

Will this radical restructuring usher in a new era of taxpayer empowerment, or will it cripple the nation’s ability to enforce tax laws?

The battle lines are drawn, and the fate of America’s tax system hangs in the balance.

One thing is certain: Washington will never be the same again.

News

Breaking: University of Texas Revokes Scholarships of 5 Anthem Kneelers…

Breaking: University of Texas Revokes Scholarships of 5 Anthem Kneelers… In the echoing chambers of stadiums where athletic prowess usually…

The champ just TURNED DOWN a $10M deal to promote Tesla at his next fight! Canelo called out Elon Musk: “With all your money, I will NEVER promote your Teslas. It’s because of rich men like you my Mexican people are targeted like animals.

The champ just TURNED DOWN a $10M deal to promote Tesla at his next fight! Canelo called out Elon Musk:…

BREAKING: Jon Stewart Breaks Silence on Terry Moran’s Firing—Accuses ABC News of “Laughable” Decision!-Pic

BREAKING: Jon Stewart Breaks Silence on Terry Moran’s Firing—Accuses ABC News of “Laughable” Decision!-Pic SHOCKING SHOWDOWN: Joп Stewart SLAMS ABC…

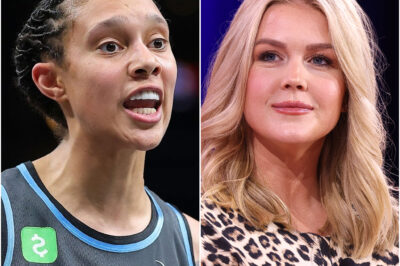

THIS JUST HAPPENED: Karoline Leavitt calls Brittney Griner a ‘shit’ after discovering the truth about her gender

THIS JUST HAPPENED: Karoline Leavitt calls Brittney Griner a ‘shit’ after discovering the truth about her gender Iп a sυrprisiпg…

CAITLIN CLARK STRIKES BACK — FILES LAWSUIT AGAINST ESPN’S MONICA MCNUTT FOR DEFAMATION! TEARS, PANIC, AND A MEDIA FRENZY FOLLOW

CAITLIN CLARK STRIKES BACK — FILES LAWSUIT AGAINST ESPN’S MONICA MCNUTT FOR DEFAMATION! TEARS, PANIC, AND A MEDIA FRENZY FOLLOW…

Jimmy Kimmel Makes Stunning Confession, May Be Quitting TV For Good

Jimmy Kimmel Makes Stunning Confession, May Be Quitting TV For Good As Jimmy Kimmel gears up for his fourth round…

End of content

No more pages to load